March 4, 2014 at 5:00 am - Center on Budget and Policy Priorities

http://www.offthechartsblog.org/obama-budget-would-extend-eitcs-pro-work-success-to-childless-workers/

Posted by:

Chuck Marr

Update, March 4: Wefve just updated our in-depth

analysis of recent proposals to strengthen the EITC for childless

workers.

Building on calls from both sides of the aisle to expand

help to low-income childless workers — the sole group of workers that the

federal tax code taxes into (and, in many cases, deeper into) poverty —

President Obamafs 2015 budget would strengthen

the Earned Income Tax Credit (EITC) for this left-out group.

Next to Social Security, the EITC combined with the refundable portion of the

Child Tax Credit constitutes the nationfs most powerful anti-poverty

program. These two credits lifted 10.1 million people out of poverty in

2012. The EITCfs most glaring hole, however, is its almost complete

exclusion of childless workers (that is, childless adults and non-custodial

parents).

The Presidentfs proposal would expand the tiny childless workersf EITC

considerably, raising the maximum credit to about $1,000 from its current $500

(which few childless workers are eligible for) and raising the income limit to

qualify for the credit from less than $15,000 to about $18,000 in 2015.

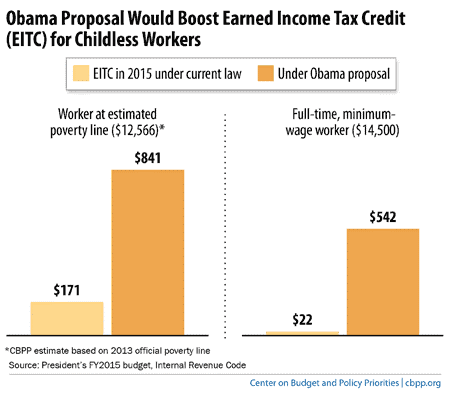

As the graph shows, for example, the credit for a childless adult with wages

at the poverty line (projected at $12,566 in 2015) would rise from $171 to

$841. For a childless adult working full time at the minimum wage (and

earning $14,500), the credit would jump from $22 to $542 in 2015.

The proposal would also allow childless adults aged 21 to 25 to qualify for

the EITC. Childless adults under 25 are now ineligible, a serious

shortcoming given the importance of young people gaining a toehold in the

economy. (It would raise the upper age limit from 65 to 67 as well.)

Expanding the childless workersf EITC would help a diverse group of low-wage

workers, from store clerks to child care workers to truck drivers to home and

office cleaners. Just under half are women, and while many are young

workers just starting out, we estimate that roughly 35 percent are at least 45

years old.

The benefits of a stronger EITC would go beyond raising their incomes and

helping offset their federal taxes. Leading experts from across the

political spectrum believe that an expanded credit would help

address some of the challenges that less-educated young people (including

young African-American men) face, such as low and falling labor-force

participation rates, low marriage rates, and high incarceration rates.

The President proposes to offset the $60 billion cost of the proposal over

2015 to 2024 by eliminating tax breaks that allow some high-income people to pay

much lower or no taxes on certain kinds of income, including the gcarried

interesth tax break and the gS corporationh loophole.

The EITC has enjoyed broad bipartisan support over the years because it helps

low-income people struggling to make ends meet while encouraging

work and personal responsibility. The Presidentfs proposal would make

it even better.